India’s New Aviation Policy: Will it be a Game Changer?

by Ramesh Vaidyanathan with Advaya Legal in Mumbai, India

by Ramesh Vaidyanathan with Advaya Legal in Mumbai, India

India’s booming economy and growing middle class have helped to make it the world’s fastest-growing air travel market. India is the ninth largest civil aviation market in the world and aims to become the third largest by 2022. More than 85 international airlines operate in India, and five Indian carriers offer service to over 40 countries. The Government of India (GoI) aims to grow domestic passenger traffic from 80 million in 2015 to 300 million by 2022.

Because the development of the Indian aviation sector can have a multiplier effect on the nation’s economy in terms of investments, tourism, and employment, the GoI has developed an aggressive plan to promote the sector. As the first significant step in implementing this plan, the GoI recently unveiled the much-awaited Civil Aviation Policy (Policy).2 This is the first time since India’s independence that the GoI’s Ministry of Civil Aviation (MoCA) has propounded an integrated civil aviation policy. The Policy reflects an intent to migrate to a more liberal administrative and regulatory regime for the aviation sector in India. It also seeks to relax rules for airlines to fly overseas and substantially increase regional air connectivity.

The Policy’s fundamental objectives are affordability and connectivity of air services and facilitation of doing business in India. With the Policy, the GoI plans to create an ecosystem that will facilitate an increase in air travel. It hopes to stimulate 300 million air ticket sales per year in the domestic sector by 2022 and 500 million by 2027, while for international travel, the target is 200 million annual ticket sales by 2027.

This article first describes the recent history of Indian civil aviation and the current state of the aviation sector and its regulatory framework. Next, the article describes the GoI’s reform initiatives, including liberalizing restrictions on foreign direct investment (FDI) in Indian air carriers and aviation companies and the new Policy, which promises to reform all of the key areas of India’s civil aviation sector. The article concludes that the FDI liberalization initiative and the Policy, while imperfect, provide a path to enable substantial growth and modernization of the aviation sector, which can play a vital role in India’s continuing economic development.

Recent Experience of Indian Aviation

India’s aviation sector has not always been so vibrant. For many years, air travel was a preserve of the rich as high fares deterred many from traveling by air. Over the last two decades, however, the air travel market has expanded due to rapid economic growth, an expanding middle class, higher disposable incomes, the emergence of low-cost carriers, modern airports, increased FDI, sophisticated information technology, and a growing emphasis on regional connectivity. A huge tide of first-time air passengers has emerged, attracted by the services of popular domestic low-cost carriers.

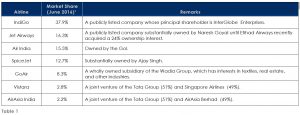

Largest Indian Airlines

The Indian air transport market has become highly competitive over recent years. While many airlines have suffered from escalating operating costs, flawed strategies, and inelastic pricing, consistent levels of traffic growth have kept them solvent. India’s largest domestic airlines are listed in table 1.

Indian Airports

India has about 449 airports and airstrips, of which around 125 airports are owned and managed by GoI- owned and controlled Airports Authority of India (AAI). Until recently, AAI was the only major player involved in developing and operating airports in India. Like most GoI-controlled enterprises, AAI suffered from a lack of resources and talent, governmental/ bureaucratic interference, and a paucity of profes- sional management. The GoI, recognizing the need

for reform, decided to invite private investment into India’s civil aviation infrastructure.

The private sector, including foreign investors, was attracted to participate in the operation, management, and development of Indian airports through various public-private partnership (PPP) models, with substantial state support in terms of financing, concessionary land allotments, tax, and other incentives. This has helped to produce world-class airports at Mumbai, Delhi, Kochi, Hyderabad, and Bengaluru, which together account for over 60 percent of the nation’s air traffic. The largest PPP airports in India are listed in table 2.

India’s Civil Aviation Regulatory Framework

Aviation is a subject included in the Union List of the Constitution of India.7 Accordingly, the national parliament has exclusive power to legislate with respect to aviation. The current legal and regulatory framework for the aviation sector is as follows:

- The Ministry of Civil Aviation (MoCA) is responsible for the formulation of national policies and programs for the development and regulation of civil aviation and for devising and implementing schemes for the orderly growth and expansion of civil air transport.

- The Airports Authority of India (AAI) functions under the control and supervision of MoCA and is responsible for building and managing civil aviation infrastructure in India. Air navigation services are under AAI’s exclusive control.

- The Airports Economic Regulatory Authority of

India (AERA) is a statutory body entrusted with setting tariffs for aeronautical services and estab- lishing the amount of development and passenger service fees, as well as establishing and moni- toring performance standards relating to quality, continuity, and reliability of aviation services.

- The Directorate General of Civil Aviation (DGCA) is the regulatory body primarily responsible for the regulation of domestic and international air transport services and enforcement of civil aviation regulations, air safety, and airworthiness standards. It also coordinates all regulatory functions with the Ittnternational Civil Aviation Organization (ICAO).

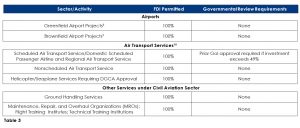

Liberalizing FDI in Civil Aviation

In a significant reform initiative, the GoI now allows 100 percent FDI in scheduled air transport service/ domestic scheduled passenger airline and regional air transport service. However, only nonairline foreign investors are allowed to acquire a 100 percent ownership interest in an Indian carrier. Under the new regime, foreign investors may acquire up to a 49 percent interest, but FDI exceeding that threshold will require prior government approval. Investments by foreign airlines in Indian airlines are limited to a minority (49 percent) interest. The new FDI regime for the aviation sector is summarized in table 3.

Relaxation of FDI restrictions will provide a much- needed boost to the Indian aviation sector at a time when some airlines were struggling to remain solvent and many were reporting losses. By allowing up to 100 percent FDI subject to certain limitations, the GoI will enable Indian airlines to access new sources of capital, which will stimulate investments in expansion and consolidation. As a policy matter, however, it is unclear why airports, cargo, MROs, and general aviation have been opened up to 100 percent FDI, yet airlines remain subject to a 49 percent limit on FDI.

The New Civil Aviation Policy

The Policy sets forth plans for an ambitious over-haul of the aviation sector with an eye on the future. The cornerstones of the Policy are competition, consumers, connectivity (within India and internationally), and investment—from both domestic and foreign investors. The GoI is convinced that this will be the key to realizing its target of growing domestic passenger traffic nearly fourfold to 300 million by 2022.

Following are key elements of the Policy.

Liberalized “Open Skies” and Codeshare Agreements

The Policy allows Indian carriers to enter into codeshare agreements with foreign carriers to any point in India and abroad consistent with the applicable bilateral air service agreement (ASA), with no prior MoCA approval required. Indian designated carriers will only have to inform MoCA 30 days prior to starting the codeshare flights. The liberalization of codeshare agreements and bilateral rights will lead to greater ease of doing business, increased competition, and wider choice for passengers. Under the present regime, India has an “open skies” ASA with the United States, but only a “near open skies” ASA with the United Kingdom, with restrictions on the frequency of flights between the United Kingdom and Delhi-Mumbai. The Policy allows India to have an “open skies” policy with all countries beyond a 5,000 km radius from Delhi based on principles of reciprocity. This will enable airlines of such countries to have unlimited access in terms of number of flights and seats to Indian airports. This is expected to increase flight frequencies with these countries. Unlimited flights above the existing ASA limitations will be allowed directly to and from major international airports within the country as notified by MoCA from time to time. For countries partly or fully within the 5,000 km radius, where Indian designated carriers have not fully utilized 80 percent of their capacity entitlements but foreign carriers have utilized their bilateral rights and are pressing for an increase in capacity, a system will be developed for the allotment of additional capacity.

Maintenance, Repair, and Overhaul (MRO)

The Policy recognizes the critical role of the MRO sector in the development of the aviation industry. Today, most Indian airlines send their aircraft overseas for maintenance and repair. As the MRO business of Indian carriers is valued at around $1 billion, 90 percent of which is currently spent outside India, the GoI is keen to develop India as an MRO hub in Asia as part of the “Make in India” initiative, which in turn will attract business from foreign airlines. MoCA will persuade state governments to make value added tax (VAT) zero-rated on MRO activities. Airport royalty and other charges will not be levied on MRO service providers for a period of five years from the date of approval of the Policy. Foreign aircraft brought to India for MRO work will be allowed to stay for the entire period of maintenance or up to six months (whichever is less), provided the aircraft does not operate any commercial flights during that period. The aircraft, however, may carry passengers on flights at the beginning and end of a stay period in India. The DGCA’s permission is required for a stay exceeding six months. The Policy also promises steps to ensure that foreign MRO experts are provided visas promptly, and in cases of an aircraft-on-ground situation, temporary landing permits will be issued, subject to certain conditions. Foreign pilots operating an aircraft to and from India for the purpose of servicing at an Indian MRO entity will be issued temporary landing permits, subject to certain conditions.

Airport Infrastructure Augmentation

Airport infrastructure is an area that needs immediate attention because the existing infrastructure is inadequate to meet the sector’s anticipated rate of growth. The Policy aims at the development and modernization of airports and upgrading of quality of services. The Policy encourages the development of airports by state governments and the private sector (including via PPPs), with greater regulatory certainty. Future greenfield and brownfield airports will have cost-efficient functionality, with no compromise on safety and security. To ensure uniformity and a level playing field across various operators, future tariffs at all airports in India will be calculated on a “hybrid till” basis, unless otherwise specified for any project being bid out. A total of 30 percent of nonaeronautical revenue will be used to cross-subsidize aeronautical charges. If the tariff in a particular year or contractual period proves to be excessive, the airport operator and regulator will explore ways to keep the tariff reasonable, and spread the excess amount over future years.

Cargo

India has tremendous potential for air cargo growth on domestic as well as international routes. Currently, the primary beneficiaries of the Indian cargo market are Indian Railways, road transporters, and foreign airlines. Development of regional cargo hubs is one of the GoI’s top priorities. Revenue from air cargo helps airlines to subsidize the cost of passenger tickets, thereby facilitating the development of a mass market for air transportation. The Policy aims to increase air cargo volumes to 10 million tons by 2027. The Policy further recognizes express delivery services as a separate segment within air cargo owing to their distinctive nature and process. The express industry is turning out to be a pivotal segment for enhancing exports, especially in the small and medium-sized enterprises segment, in view of the expansion of e-commerce and other new age industries. The Policy aims at encouraging airport operators to provide space for at least 10 years via lease to operators of express cargo freighters, which may then develop dedicated infrastructure to improve their operational efficiency. The Policy also aims to establish free trade and warehousing zones to facilitate transshipment cargo. With the GoI’s emphasis on “Make in India,” “ease of doing business,” and enhancement of exports, it is extremely important to enhance infrastructure to stimulate growth of the air cargo sector.

5/20 Rule Replaced

International operations are lucrative for airlines because they generate higher yields, enable better utilization of aircraft, and permit airlines to purchase cheaper jet fuel overseas. Under the 5/20 rule, only Indian airlines that had at least five years of operational experience and a minimum fleet of 20 aircraft were allowed to fly internationally. Over time, however, the increasingly prevalent view was that this restriction, which is unique to India, needed to be replaced by a scheme that would provide a level playing field and allow airlines, both new and old, to introduce international operations provided they continued to meet some obligation regarding domestic operations. The aviation ministry faced aggressive opposition to elimination of the 5/20 rule by older airlines such as Jet Airways, IndiGo, SpiceJet, and GoAir, while new entrants such as Vistara and AirAsia advocated for the rule’s abolition. The Policy discarded the controversial 5/20 rule, and now any domestic airline may fly overseas provided it deploys 20 planes or 20 percent of its total capacity11 for domestic operations. The GoI does not want airlines to focus on international operations to the detriment of domestic service; rather it wants airlines that are allowed to fly internationally to ensure that their domestic flights account for at least 20 percent of their total seats.

Ground Handling Policy

The existing ground handling policy is being replaced with a new framework to ensure fair competition. Under the new policy, domestic airlines will be permitted to self-handle at all airports to ensure competition as well as cost savings. In addition, airport operators must ensure that there will be at least three ground handling companies, including Air India’s subsidiary/joint venture partner, in competition with each other at all major airports. At nonmajor airports, the airport operator will determine the number of ground handling companies, based on traffic output and airside/terminal building capacity. All domestic scheduled airline operators, including helicopter operators, will be free to self-handle at all airports.

Helicopters

Helicopters play a key role in ensuring remote area connectivity, intra-city movement, tourism, law enforcement, disaster relief, search and rescue, and emergency medical evacuation. India currently has fewer than 300 civilian helicopters, which is abysmally low compared to other developing nations. The Policy aims at encouraging helicopter usage by facilitating the development of at least four heli-hubs initially across the country to promote regional connectivity. Airport charges for helicopter operations will be reduced, and a separate helicopter department will be created within the DGCA.

Regional Connectivity Scheme (RCS)

The Policy aims at enhancing regional connectivity within India through financial support and infrastructure development. As part of RCS, the GoI aims to connect unserved and underserved destinations for which fares will be capped at INR 2,500 (approximately US$35) for a one-hour flight. Airlines will be allowed to self-handle for operations under RCS at all airports. RCS will take “flying to the masses” by connecting India’s remote, unserved, or underserved regions, thereby increasing tourism and generating employment. RCS will require a huge number of small aircraft to cater to regional service, thereby creating a new opportunity to invest in the flourishing Indian aviation sector.

Conclusion

While India’s Civil Aviation Policy has flaws and limitations, its overall roadmap for reform and liberalization is clear and ambitious. The Policy aims to foster a more conducive investment climate, which should improve the Indian aviation sector’s access to capital, thereby stimulating growth. In conjunction with the liberalized FDI rules, the Policy is expected to pave the way for the launch of new airlines and increase the number of flights, lower prices, and elevate demand for skilled workers, while also fostering aviation leasing and financing activities. The real challenge will be the management of the exponential growth of Indian air traffic without compromising on safety.

Endnotes

- Domestic Traffic Reports: June 2016, Directorate Gen. of civil aviation (DGca), http://dgca.nic.in/reports/Traf- fic_reports/Traffic_Rep0616.pdf (domestic market share by passengers carried in 2016).

- National Civil Aviation Policy 2016 (effective June 15, 2016) (India), http://www.civilaviation.gov.in/sites/default/ files/Final_NCAP_2016_15-06-2016-2_1.pdf.

- Airlines, inDira GanDhi int’l

airport, http://www.newdelhiairport.in/ air-lines.aspx (last updated Aug. 16 , 2016).

- Traffic Performance, chhatrapati Shivaji int’l airport,

http://www.csia.in/aero-marketing/traffic-performance.aspx

(last visited Aug. 22, 2016).

- Kempegowda International Airport, Bengaluru Clocks over 18 Million Passengers in 2015, KempeGowDa int’l airport, BenGaluru ( Jan. 19, 2016), http://www.bengaluruairport. com/ourBusiness/mediaCenter.jspx.

- Fact Sheet: Hyderabad Passenger Traffic, rajiv Gan- Dhi int’l airport, http://www.hyderabad.aero/fact-sheet.aspx (last visited Aug. 22, 2016).

- The Union List is a list of items enumerated in the Constitution of India over which the Indian Parliament has exclusive power to

- A greenfield airport project involves constructing a new airport on an undeveloped

- A brownfield airport project involves modifying or updating an existing

- Foreign airlines may not acquire more than a 49 percent ownership interest in an Indian company operating scheduled and nonscheduled air transport services, subject to GoI

- Total capacity is calculated based on the average number of seats for all

Published in The Air & Space Lawyer, Volume 29, Number 3, 2016. © 2016 by the American Bar Association. Reproduced with permission. All rights reserved. This information or any portion thereof may not be copied or disseminated in any form or by any means or stored in an electronic database or retrieval system without the express written consent of the American Bar Association.