Tax

14. Will the relevant law require any cargo, airport (departure) or passenger taxes?

Austria

Austrian Air Transport Levy (ATL) is a departure tax charged on the carriage, from one of the six major Austrian airports (Vienna, Salzburg, Linz, Innsbruck, Klagenfurt, Graz), of passengers on board aircraft with an authorized weight of more than 2,000 Kg (4,400 lbs.). The Air Travel Tax is levied on the carriage, from an Austrian airport, of paying passengers on passenger aircraft. It becomes due at the end of the calendar month when the flight was performed and is payable by the operator of the aircraft. The amount due is dependent upon the final destination, e.g. for short-haul flights it amounts to € 3,50 per passenger; for medium-haul flights will amount to € 7,50 per passenger; and for long-haul flights will amount to € 17,50 per passenger.

The Air Travel Tax Act also provides for exemptions, e.g. for children under two years of age who do not have their own seat on the flight; and for cargo flights which carry no passengers.

Brazil

Yes. Domestic cargo transport is subject to “ISS”, which is a service tax over cargo transport due when the transport occurs inside of a specific city or between cities inside the same State in Brazil. The ICMS (described above) is due on passenger and cargo transport between States in Brazil and in international transport. There is a wide range of tax rates for ICMS over cargo transport domestic and internationally depending on the nature of the cargo.

Colombia

In the first instance it is important to clarify that, in Colombia, the departure tax and the airport tax are two different levies. In this way, their tax treatment is done as follows and corresponds to the taxes that passengers must pay within their plane tickets:

National stamp tax by departure: is the value that must be paid by both Colombians and foreigners residing in Colombia when leaving the country by air, as defined by Resolution 1545 of 2015. The second Article of that Resolution provides that the charge of that tax shall be made by means of the price of all tickets and air contracts. In this way, the airlines will collect this tax.

The value of this tax corresponds to 2.6 UVT whose values are set annually by the National Taxes and Customs Office in Colombia. (DIAN)

However, Colombian nationals and foreigners entering the country for visit or transit shall not pay the tax. Resolution 1545 of 2015 states that visit should be understood as the entry to the country that does not exceed 60 calendar days; and as transit, one must understand the stopover or transfer made by the foreigner within the Colombian territory, as part of his flight itinerary, which continues to another city other than the one of origin outside Colombia.

- Airport fee: is a contribution established by law due to the use given by passengers to public airport facilities, value that must be included within the price of the ticket.

This fee may be national or international. It is national when the flight has as its final destination a point in Colombia; and, when in the flight schedule of a private aircraft has as last destination a point within Colombia and its passengers make use of public terminals. Currently, this national airport fee costs COL $15,900.

The airport fee is international when, unlike the national one, the end points of the flight plans are abroad, and passengers use the public terminals in Colombia during their transit. Its value today is USD$39, at the value of the representative market rate for the 14th and 28th of each month, as established by Resolution 5496 of 2005.

- Administrative fee: Resolution 3596 of 2006 defines the administrative fee as the mandatory non-refundable charge for the issuance of air passenger transport tickets, national and international.

Pursuant to Resolution 3596 of 2006, the Civil Aeronautics is responsible for establishing the value of the administrative fee annually based on the Consumer Price Index (CPI) of the immediately preceding year. These values will be for both the national and international administrative fees.

This fee is charged by travel agencies, intermediaries and airlines in their direct sales. However, when ticket sales are carried entirely via Internet, airlines and travel agencies may charge a different administrative fee than the one Civil Aeronautics indicates.

When the administrative fee is international, there will be a charge of sales tax with a 19% fee.

- Sales tax: in accordance with the Tax Statute, the air transport of passengers is subject to sales tax, with the general fare of 19%. However, Article 476 of the same Statute excludes from this tax some national routes to certain destinations such as: the department of the Archipelago of San Andrés, Providencia and Santa Catalina, la Pedrera, Leticia and Tarapacá in the department of Amazonas, in the Choco the destinations of Acandí, Capurganá, Nuquí, Bahía Solano, Bajo Baudó, Juradó, among others. These territories and sites excluded from sales tax are established by the Decree 1625 of 2016, in article 1.3.1.13.16.

In addition, Article 461 of the Tax Statute provides that, in the case of international passenger air transport, sales tax shall be settled on 50% of the value of the ticket when round-trip is issued; and will be 100% of the ticket value when it’s a one-way ticket.

When it is a return ticket purchased abroad and the one-way trip begins abroad and the return trip in Colombia, or sales tax will be caused, according to the state council’s ruling of November 13, 2014.

- Fuel charge: The airline is free to determine the cost for the aircraft’s fuel.

- Tourism tax: it is caused by the entry of foreign persons to Colombia in means of air transport of international traffic. Currently its rate is US$15 or its equivalent in Colombian pesos. This tax must be included by the airlines in the heat of the air tickets and they will be responsible for their collection.

They are exempt from payment of this tax, diplomatic and consular agents, crew of international transit aircraft, students, fellows and teachers, passengers in transit and those who enter Colombia in cases of arrival forced or emergency medical caused on board.

There are excise duties and fees for certain areas of Colombia that are also included within the value of the air ticket which are:

- Tourist card tax and use of public tourist infrastructure (San Andrés, Providencia and Santa Catalina): It consists in the payment for the entrance to the Archipelago either as a tourist or temporary resident. Its value is determined by the CPI.

- Contribution to tourism (Leticia): it is a levy to be paid by any domestic or foreign tourist entering Leticia for a time not less than 24 hours and not more than 90 days for the purpose of resting or recreational.

- Table Border Pro-development (Cucuta): the use of the stamp will be mandatory when air transport tickets have routes that leave the Department of Norte de Santander.

Czech Republic

There are no cargo, airport or passenger taxes levied by the government in the Czech Republic. However, airport charges charged by airport operators may include components derived from passenger incoming/outgoing or dependent on the noise generated by the aircraft; as concerns the latter, aircraft are broken down into noise classes.

Germany

Germany currently levies a ticket tax on departing passengers: the German Air Transport Tax (in German: “Luftverkehrssteuer”). The tax rate is differentiated according to the distance of the biggest commercial airport in the country of destination from Germany’s largest airport, Frankfurt am Main. There are 3 categories:

- Annex 1 countries include the EU and EFTA member states, domestic flights, EU candidate countries and Turkey, Russia, Morocco, Tunisia and Algeria, which are taxed at EUR 7.46 (2018), respectively EUR 7.38 (2019) per passenger.

- Annex 2 countries are those not listed in Annex 1 and with a distance of not more than 6,000 kilometers, which includes countries in North and Central Africa, Middle East and Central Asia, which are taxed at EUR 23.31 (2018), respectively EUR 23.05 (2019) per passenger.

- the rest of the countries not in Annex 1 or 2 are charged at EUR 41.97 (2018), respectively EUR 41.49 (2019) per passenger.

Such tax is payable by the commercial airline that performs the flight departing from an airport in Germany.

According to the German federal government’s package of climate policies that was adopted on 16 October 2019 by the cabinet, the German Air Transport Tax will be increased from April 2020 on as follows:

- Annex 1: EUR 13.03

- Annex 2: EUR 33.01

- Annex 3: EUR 59.43

The implementation of the planned changes is still open and there might be changes in the legislative process.

Airlines that operate in Germany – including foreign airlines who have at least a branch office in Germany – are required to register with the relevant authorities. Airlines without a branch office in Germany who offer flights from German airports are required to appoint a licensed tax representative and to prove that by documentation to the relevant authorities.

The airline and its licensed tax representative will be jointly and severally liable for the tax. If a foreign airline fails to nominate a tax representative, the owners and operators of the aircraft will be deemed liable for that tax. If the tax authorities suspect that the taxes will not be paid, clearance to takeoff or landing may be denied.

Airlines that do not provide scheduled air services (i.e. charter flights) have to notify the main customs office responsible for it at least three days prior to the respective flight. Tax debtors have up to 10 days after the end of a calendar month (in which the tax originated) to provide a tax declaration to the tax authorities. The airline or its tax representative is obliged to maintain records of the amount of tax due and the basis of its calculation. On the 20th day of each month the tax for previous month becomes due.

Greece

Greek law provides for cargo, airport (departure) and passenger airport charges. Please, find attached a pdf file showing the current list of charges, issued by the Athens International Airport.

Israel

No cargo, airport or passenger taxes are levied by the government of Israel. However, airport fees charged by airport operators may include components deriving from incoming/outgoing passengers , cargo, etc.

Italy

The supply of air services is generally subject to a significant number of taxes/charges, including:

– embarkation tax (IT code);

– passenger service charge departure – for assistance to disabled persons and persons with reduced mobility (MJ code);

– security charge in relation to passengers and hand baggage (VT code);

– council city tax (HB code);

– VAT on airport charges (FN code);

– carrier-imposed surcharge for safety, insurance and fuel (YQ code);

– carried-imposed surcharge for ticket sale services (YR code);

– checked baggage control charges (EX code).

Kenya

- VAT

KCAA imposes various charges to aircrafts operators including, landing charges, parking charges, aircraft handling charges, air navigation charges and en-route charges. These charges are not exempt from VAT under the VAT Act and therefore VAT at the rate of 16% is applicable on the fees/charges payable by aircraft operators/owners.

The airfare payable by passengers for local flights is exempt from VAT whereas the airfare payable in respect of transportation of passengers on international flights is zero-rated for VAT purposes.

Mexico

Yes, airport use tariff is a tax collected by the airlines and charged to passengers (domestic and international) on departing flights per airport (plus VAT). It is determined by the airport concession holder for the rendering of airport services and primarily used to enhance airport infrastructure.

Nigeria

A 5% cargo sales charge is payable to the NCAA. The charge is based on the total cost of cargo fees paid by the client, inclusive of any other charge added to the total cost of travel.

The Value Added Tax Act (Modification) Order exempts transport services available for use by the public from the payment of VAT. Thus, flight tickets are zero rated for the purposes of VAT.

Norway

Avinor is the Norwegian national air navigation services and operates 44 airports in Norway. Airlines that uses Avinor airports are required to pay different levies. According to the regulation relating to charges at Avinor AS’s airports, the following charges shall apply:

Take-off charge: NOK 62

Passenger charge: NOK 48

Passenger transfer abroad: NOK 34

Security charge: NOK 60

More information can be found here: https://avinor.no/en/aviation/route-development/charges/

There is also a tax on the transport by air of passengers from Norwegian airports. There are two rates depending on the final destination: a low rate for journeys with a final destination in Europe, and a high rate for journeys to other final destinations:

Low rate: NOK 75 per passenger

High rate: NOK 200 per passenger

Panama

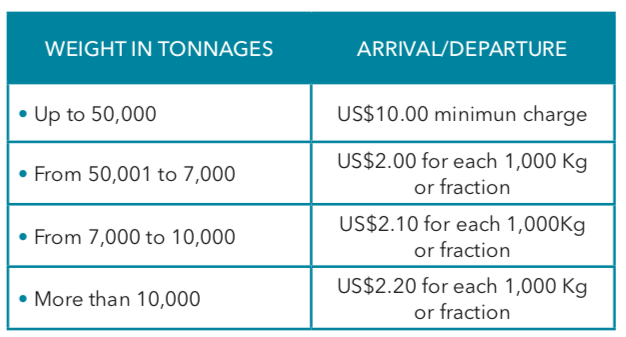

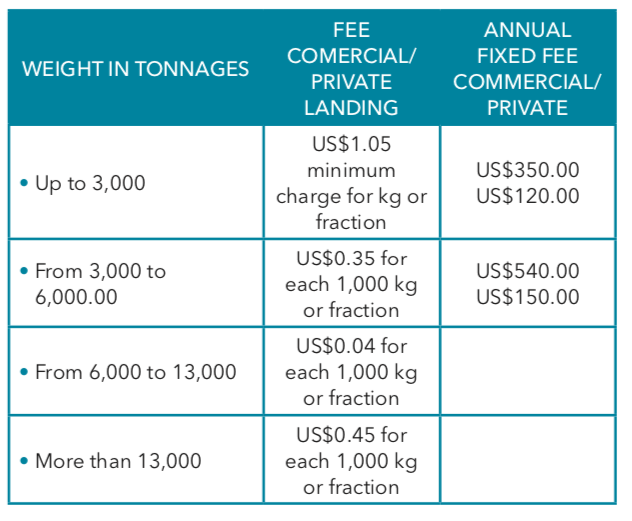

There are no cargo, airport or passenger taxes in the Republic of Panama. Tocumen International Airport charges the following fees:

Passenger service fee US$20.00 per passenger.

Air transit fees:

-Internal flights

Aircraft Parking fees:

For internal flights after 12 hours after landing, US$0.25 for each 1,000 Kg or fraction of 1,000 Kg of the weight of the aircraft for each 24 hours.

Minimum charge US$0.75 for 24 hours.

International flights after 6 hours from landing US$0.50 for each 1,000 Kg or fraction of 1,000 Kg of the weight of the aircraft, for each hour or fraction of 6 hours.

Minimum charge US$1.50 for each 6 hours or fraction.

Peru

Cargo transportation services from the country to the exterior and from abroad to the country are exempt from payment to the VAT. On the other hand, the transportation of cargo within the national territory is taxed with VAT.

Regarding the airport, the airline must sign contracts for access before the competent administrative authority, allowing it to make use of the airport facilities in order to start their business operations, for the right to use these spaces must be paid monthly rent that is called access fee.

Regarding passenger’s service, it is taxed with VAT (18%). Additionally, they will pay an airport tariff or Unified Rate of Airport Use (TUUA) which is related to the various services provided by the airport to passengers in its facilities. The TUUA must be included in the air tickets.

Portugal

Yes, including air navigation.

Puerto Rico

There is no state legislation covering this matter in Puerto Rico, but Article 3.8 of Regulation 6980 of the Puerto Rico Ports Authority (“Authority”) imposes passenger fees. These fees are assessed according to the flight origin and destination for space used in common by the air carriers using the Luis Muñoz Marín International Airport (LMM).

Charges for Common Use Space cover the equivalent rent for holdrooms, sterile passenger circulation areas, baggage makeup areas, and baggage claim areas.

Romania

By Government Decision no. 455/2011 Romania transposed into domestic legislation the provisions of the Directive 2009/12/EC of the European Parliament and of the Council of 11 March 2009 on airport charges.

Pursuant to the above mentioned legislation ”airport charge” means a levy collected for the benefit of the airport managing body and paid by the airport users for the use of facilities and services, which are exclusively provided by the airport managing body and which are related to landing, take-off, lighting and parking of aircraft, and processing of passengers and freight.

By Government Decision no. 455/2011 are regulated only the common principles for levying airport fares on airports in Romania but not the fares which are established on nondiscriminatory basis by each airport.

South Africa

- This is dealt with by the terms of the “Conditions of Use” imposed on operators by the Airports Company of South Africa and other aerodrome operators, airport taxes, air navigation charges and landing charges and hangarage accrue and arise automatically and attach to the relevant aircraft

Spain

Passenger, PRMs and Security charges apply for the provision of airport facilities. The taxpayer are the Airlines, administrations, organizations and individuals carrying passengers who board at an airport managed by Aena. The amount of these charges is surcharged to the passengers on the ticket price. Rates depend on the Spanish departure airport and the aircraft destination.

Switzerland

In general, there are no particular cargo, airport or passenger taxes levied in Switzerland. However, at various airports in Switzerland, a passenger tax is levied, and the landing charges payable include a component dependent on the noise generated by the aircraft. To this end, aircraft are broken down into noise classes. Furthermore, in line with the EU recommendations (also known as recommendation ECAC 27/4) ECAC, there are charges levied depending on the absolute amount of NOx emissions.

United States (Miami)

Fuel Tax depends on the type of aircraft operations. FET on fuel is charged per gallon of fuel purchased. In general, FET on fuel applies to both commercial and noncommercial air transportation, but at different rates.

FEDERAL FUEL TAX RATES 2019

- Aviation Gasoline (Avgas) 19.4¢

- Jet Fuel (Non-commercial Aviation) 21.9¢

- Jet Fuel (Used in Commercial Aviation) 4.4¢

- Jet Fuel (Delivered by Truck) 24.4¢