Tax

5. Will the relevant law require any import (value added) tax and/or customs duties to be payable on the import of an aircraft in the relevant jurisdiction?

Austria

There is no import (value added) tax and/or customs duties for commercial air transport business (see the exemption provision of the Austrian VAT Act as explained in Section 1.a. above).

Brazil

Possibly. Importation of aircraft under purchase agreements are subject to ICMS (similar to VAT tax and described in section 1 above), Import Tax (“II”) and Federal Excise Tax (“IPI”) and COFINS. For importation under aircraft lease agreements there are some tax benefits and reduction of tax rates. The benefits and reductions of these taxes vary depending on the type of importer (e.g., regularly scheduled carriers enjoy certain benefits), the type of aircraft and the type of lease (e.g., operating or finance lease). There is an additional tax applicable on all aircraft imports, called “COFINS”, which was not applicable to aircraft imports prior to 2013. Based on a change in law that occurred in late 2013 the SRF began to assess the COFINS tax on aircraft imports beginning in the last quarter of 2014. Airlines have been challenging the assessment of the COFINS tax on the importation of commercial aircraft under lease agreements. To date most airlines have been able to avoid paying such COFINS tax, however, this has been based on interim judicial rulings and not final decisions on the merits of the applicability of the COFINS tax. If and when applicable the COFINS tax would be 1% of the value of an aircraft at the time of importation.

Colombia

Under Colombian law, the importation of an aircraft can be carried out in two ways: either temporarily or permanently.

In the case of a temporary importation, Decree 1165 of 2019 in Article 142 provides that the aircraft shall be imported for the time in which the activity is carried out (download, cargo, maintenance, etc.) and must be re-exported. When the re-export is not carried out, in accordance with Article 220 of the same Decree, a financial penalty shall be faced for each month of delay and the aircraft shall be immobilized.

Article 142, in turn, provides that in cases where there is an aircraft exchange contract authorized and registered by the competent authority, there will be no need for customs procedures nor duties.

In the case of a permanent importation, it shall be made in cases where it is intended to nationalize an aircraft by means of the registration of that aircraft as Colombian.

In addition, the importation of aircraft causes sales tax, in accordance to Article 420 of the Colombian Tax Statute, which establishes importation as a chargeable event for this tax. Therefore, under Article 184 of Decree 1819 of 2016, the general rate of 19% shall apply to all aircrafts’ imports. It is a tax borne by the importer and will be collected in full by the Colombian Civil Aeronautics.

Article 459 of the Tax Statute determines the taxable basis for sales tax for import cases, the same being on which customs duties would be settled.

According to Decree 2153 of 2016, aircraft imports are taxed at a tariff rate of 0%. This means that they are subject to tariffs, but their rate is equal to zero.

Czech Republic

Importing an aircraft to the Czech Republic is subject to customs duties pursuant to the European Union Customs Code, whereas aircraft for civilian use usually enjoy the benefit of 0% customs duties. As concerns VAT, importing an aircraft to be operated by an airline for reward chiefly on international routes is exempt from VAT in the Czech Republic. However, should the importer not meet the condition for exemption, it needs to declare (self-assess) and pay VAT at the rate of 21% of the purchase price in the case of a purchase or from the lease payments in the case of a lease. This is without prejudice that the VAT may be subject to entitlement for a VAT deduction, provided that the general requirements are met.

Germany

No customs duty or import VAT is payable if an aircraft is brought to Germany from another EU member state.

However, if an aircraft originating in a non-EU member state is imported into Germany, it is (in general) subject to import VAT (Section 1 (1) No.4 of the VAT Act). The tax burden rests on the person who legally owes duties for a customs debt incurred on importation, namely the applicant (sections 13a (2) and 21 (2) of the VAT Act in connection with the EU Customs Code – Regulation (EU) No. 952/2013).

According to customs tariff number 8802 400100 are civil fixed wing aircraft that have an empty weight of more than 15,000 kilogram exempt from customs duty. For others, customs duties may (in general) be charged if they are imported from a non-EU member state.

Aircraft not registered in any of the EU member states may not have to pay customs duties and import VAT if they fly the aircraft into Germany under a temporary admission. Aircraft registered in the EU (that includes M and 2/ZJ registration) are not eligible for a temporary admission and therefore not allowed to fly in the EU Customs Territory without payment of customs duty and VAT – not even a single entry into the EU is allowed. Thus, all aircraft using an aircraft registration within the EU Customs Territory (Isle of Man, Guernsey and Jersey belong to the EU Customs Territory) must be fully imported at the first port of call in the EU if not already imported.

However, no customs duty and import VAT will be charged in Germany if the aircraft is imported (from a non-EU country) by a German airline who is (i) the owner or the lessee of the aircraft and (ii) exempt from VAT as it predominately operates (on a commercial basis) on international routes (Section 5 (1) No. 2 and Section 8 (2) No.1 of the VAT Act; see exemption mentioned under No. 1 above).

Greece

As regards imports, VAT is on principle chargeable (as well as customs duties, where applicable) at the time of importation of goods (article 17 in conjunction with art. 60 of the VAT Code).

However, civil aircraft are exempt from customs duties, according to Section II, par. B (1) of EU Regulation 2018/1602 (directly applicable in Greece).

Furthermore, in relation to VAT, when goods are placed -upon importation- under a special customs suspension status, VAT becomes due at the time that the goods exit such status. Aircraft can be placed under a “designated end use” status, in case they are intended to be used by an aviation company satisfying the «revenues’ criterion» mentioned under question (1); this can be the case irrespective of whether ownership of the respective aircraft is transferred to the qualifying aviation company or the aircraft is delivered thereto pursuant to a lease arrangement; when the designated end use ends (e.g. the respective aircraft lease is terminated) the aircraft has to be exported or the corresponding VAT be paid.

Israel

The importation of an aircraft into Israel is generally subject to VAT unless exempted pursuant to applicable law. Under certain conditions, both customs duties and purchase tax would not be imposed in respect of such importation transaction but in order to obtain certainty in this respect, it is recommended that an approach be made to the relevant customs agent prior to embarking in a transaction of such nature.

Italy

Generally speaking, the importation of an aircraft in Italy is subject to VAT (at a rate of 22%).

VAT does not apply if the aircraft is imported by an airline operating for reward chiefly on international routes, as per the implementation of the general VAT exemption provided for the aviation sector under the EU Directive 2006/112 (on the common system of value added tax).

Besides, under certain conditions (such as if the aircraft is registered, owned and based outside the EU) and time limitation (maximum 6 months per entry) the “temporary importation” regime does exempt the aircraft owner to pay VAT.

Kenya

Import duty is charged at various rates (i.e. 0%, 10% or 25%) on an ad valorem basis on the customs value of the goods pursuant to the East African Community Customs Management Act, 2004. The import duty rate is dependent on the nature and description of the goods as set out in Annex I to the Protocol on the Establishment of the East African Community (EAC) Customs Union (referred to as the Common External Tariff code). The value for purposes of import duty assessment is normally based on the cost, insurance and freight (CIF) value of the goods imported. However, other valuation methods, such as Transaction Value of Identical Goods, are applied where importation is made from a related non-resident party.

Aircrafts and aircraft parts are subject to import duty at the rate of zero per cent under the EAC Common External Tariff code.

- VAT

As stated under question 1 above, importation of aeroplanes and other aircraft of unladed weight exceeding 2,000 kilograms (excluding helicopters) into Kenya is exempt from VAT.

- Excise duty

Excise duty is chargeable on excisable goods manufactured in Kenya by a licensed manufacturer, excisable goods imported into Kenya (for example motor vehicles) and excisable services supplied in Kenya by a licensed person, at various specific rates provided under the First Schedule to the Excise Duty Act, 2015.

Aircraft and aircraft parts are not listed as excisable goods under the First Schedule to the Excise Duty Act, 2015 and therefore their importation to Kenya is not subject to excise duty.

- Import Declaration Fee (IDF)

IDF is charged at the rate of 3.5% of the customs value of chargeable goods imported for use in Kenya pursuant to the provisions of the Miscellaneous Fees and Levies Act, 2016. Importation of aircraft (excluding helicopters) of unladed weight exceeding 2,000 kilograms into Kenya is exempt from IDF.

- Railway Development Levy (RDL)

RDL is charged at a rate of 2% of the customs value of chargeable goods imported for use in Kenya pursuant to the provisions of the Miscellaneous Fees and Levies Act, 2016. Importation of aircraft is chargeable to RDL and payable by the importer at the port of entry into Kenya. Goods from the EAC Partner States are exempt from RDL as long as they meet the EAC Rules of Origin requirements.

- Pre-Export Verification of Conformity to Standards (PVoC)

PVoC is not a customs duty or levy but a programme whereby goods destined for Kenya are required to undergo an inspection at the port of origin and be issued with a Certificate of Conformity (CoC) to Kenya standards. Presentation of the CoC is a mandatory requirement to facilitate clearance of imports by both the Kenya Revenue Authority and the Kenya Bureau of Standards at the port of entry. While some imports are exempt from the PVoC process, they would still be subject to destination inspection at the port of entry into Kenya. This process would need to be complied with by an importer of aircraft.

Mexico

Importation of the aircraft is subject to VAT at the rate of 16%, general importation tax and customs duties payable by the importer.

Temporary importations are neither subject to VAT nor general importation tax.

Nigeria

Yes, the import of aircraft will attract the payment of custom duties by virtue of the CET Act. However, the import of aircraft and spare parts into Nigeria are zero rated for the purposes of VAT by virtue of the Federal Inland Revenue Service Information No. 9701 which exempts the payment of VAT on the importation of aircraft and aircraft spare parts.

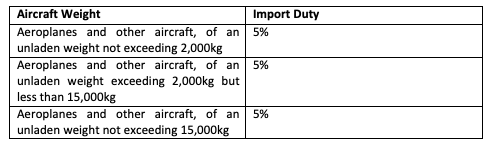

a. The import duty chargeable on aircraft will depend on the weight of the aircraft. The rates are assessed as follows:

Norway

The main rule is that VAT (currently 25%) shall be payable on the import of all goods to the Norwegian VAT area. The parties importing an aircraft will, as a starting point, be able to get a deduction for the import VAT, provided that they are engaged in taxable activities in Norway. A company is liable to register for VAT if its supplies and withdrawals that are covered by the Norwegian VAT Act exceed NOK 50,000 during a 12-month period. The Norwegian VAT Act allows the company to be pre-registered for VAT in Norway. Once registered in the VAT Register, the import VAT will initially only have to be reported, but not paid, as a deduction may be required in the same tax return for VAT that the import took place.

No VAT shall, however, be payable on the import of military aircrafts or aircrafts used in commercial aviation activities, cf. Norwegian VAT Act Section 7-4.

Panama

Panama Aviation law provides that companies engaged in aviation services which hold a certificate of exploitation and operation issued by the Civil Aeronautics Authority (AAC) are exempt from import tax. Aircraft that are not engaged in aviation services under a certificate of exploitation and operation issued by the AAC must pay import tax as follows:

Aircraft with empty weight less or equal to 2,000 kg:

Commercial use 15%

All others 15%

Aircraft with empty weight more than 2,000 kg but less than or equal to 15,000 kg:

Commercial use 15%

All others 15%

Aircraft with empty weight over 15,000 kg:

Commercial use 10%

All others 10%

Peru

The import of goods is taxed with the General Sales Tax, whose rate is 16% plus a municipal promotion tax equivalent to 2%.

However, customs legislation establishes a Temporary Admission Regime for re-export, established in Article 53 of the General Customs Law.

This regime allows the entry into the customs territory of certain goods (among which are aircraft, parts, parts and engines), with suspension of payment of customs duties and other taxes applicable to imports for consumption and surcharges if applicable, provided they are identifiable and are intended to meet a specific purpose in a specific place to be re-exported in a specified time without undergoing any change, with the exception of normal depreciation arising from the use that has been made of them.

Portugal

The first import of an aircraft into the EU through Portugal will trigger Portuguese VAT.

Puerto Rico

Any person who imports into Puerto Rico taxable items (as the aircraft) subject to the use tax shall file a declaration pursuant to § 31630 of the Code.

According to the Code, the use tax is imposed on account of use, consumption, or storage of any tangible goods imported into Puerto Rico. The term “use” shall not include:

(1) When the taxable item is subsequently the object of commerce in the ordinary course of business in Puerto Rico;

(2) the use of taxable items temporarily introduced into Puerto Rico that are directly related to film production, construction, trade shows, seminars, conventions, or for other purposes, and which will be re-exported from Puerto Rico.

The law generally requires that the use of the aircraft creates a sufficient nexus or connection with PR before use taxes can be imposed. In most cases, if the aircraft is based in PR, the PR Treasury Department is going to assess a use tax.

In regard to the declaration required by the Code, it shall be filed on the deadline for the corresponding tax payment. If a person is unable to furnish evidence of being a reseller or holding an exemption, it shall be presumed that all items imported are subject to the use tax and shall pay such use tax. 13 L.P.R.A. § 32092.

Romania

Under Romanian fiscal code [art. 293 para. 1 letter a)] is VAT exempt “the import and the intracommunity acquisition of goods whose delivery in Romania is exempt from value-added tax inside the country;”

In the case of aircraft used by airlines mainly engaged in international passenger and/or goods transport, are VAT exempt the following operations: delivery, modification, repair, maintenance, leasing and rental of aircrafts, as well as the delivery, leasing, rental, repair and maintenance of the equipment included or used on an aircraft.

No custom duties are payable on the import of an aircraft in Romania.

South Africa

- VAT is payable on the importation of goods (including aircraft) into SA by the importer of record. The import VAT paid may be claimed as an input tax deduction to the extent that it is used for taxable supplies and the importer is a registered VAT vendor.

- Import VAT is payable at a rate of 15% on the customs value of the goods being imported.

Spain

Yes, as established by EU common importation regulations and tariffs.

The importation of an aircraft would accrue Spanish VAT upon customs clearance. However, the importation may be VAT exempt if it is made by a qualifying international airline for the use in international transport.

Switzerland

As mentioned above, Switzerland is not a member of the EU and import into Switzerland must be dealt with separately from the EU import.

Swiss import: the import of an aircraft into Switzerland is subject to Swiss import VAT of currently 7.7% and Swiss custom duties; however, Swiss customs duties may be avoided under an end use relief system applicable to civil aircraft provided timely application is filed by the importer (i.e. the party that is in control of the aircraft after its import). Furthermore, the Swiss customs authorities thereby generally apply a substance over form approach and Swiss import VAT and Swiss custom duties applies if a Swiss resident has factual control of an aircraft (irrespective of the aircraft’s nationality) flying into Switzerland, unless the Swiss resident meets all requirements stating an exemption in specific circumstances. The Swiss VAT Act grants an exemption from Swiss VAT if the Swiss recipient is engaged in commercial air transport business and the aircraft is used exclusively in that business.

Temporary admission (hereinafter “Swiss TA”): an aircraft as a foreign good is entitled to the benefits of the Istanbul Convention and the reliefs provided by the Swiss customs law regarding the temporary admission of such foreign good in Switzerland, provided, however, that all of the following conditions are met:

- general requirements for Swiss TA: (a) the aircraft remains under the supervision of the Swiss Custom Authorities at all times during its stay in Switzerland; (b) the aircraft is owned by a non-Swiss resident entity or person; (c) the person or entity that is using the aircraft in a flight into Switzerland, or has the right to use the aircraft or has the factual control of the aircraft, is not a resident in Switzerland; (d) the aircraft maintains a non-Swiss habitual base; and

- for commercial use: (a) no domestic flights are allowed; and (b) the aircraft has to leave Switzerland, thus, terminate the temporary admission, within 1 to 2 days; or

- private use: the aircraft may remain in Switzerland for a period not exceeding six months in every period of twelve months.

If any of these conditions are not met there is a substantial risk that the aircraft will be subject to Swiss import VAT based on its actual value and to Swiss custom duties as of the first flight into Switzerland.

United States (Miami)

Yes, generally, depending upon the law of the State within the United States which may be applicable. In Florida, for example, promissory notes and other written obligations to pay money signed in Florida may be subject to documentary stamp tax. Tax is due on the full amount of the obligation evidenced by the taxable document at the rate of 35 cents per $100 or portion thereof. However, the tax due on a note or other written obligation to pay money is capped at $2,450.

Mortgages, liens, security agreements, and other evidences of indebtedness may be subject to tax and payable when filed and recorded in Florida. The tax is based on the full amount of the indebtedness secured by the mortgage or lien regardless of whether the indebtedness is contingent or absolute. The rate of tax is 35 cents per $100 or portion thereof of the amount secured thereby. There is no cap on the amount of tax due.

All parties to the document are liable for the tax regardless of who agrees to pay the tax. If one party is exempt, the tax must be paid by a non-exempt party.