Tax

15. Will the relevant law require any aviation fuel taxes?

Austria

In general, Austria levies mineral oil taxes on aviation fuel. However, airlines and other commercial flight operators are exempt from such taxes.

Brazil

Yes. The ICMS is also charged locally by each State in Brazil and it has incidence over aviation fuel. Each State has independency to define the tax rate over aviation fuel. Recently in 2019 São Paulo State reduced the ICMS tax rate from 25% to 12% and Rio de Janeiro has reduced it from 12% to 7%. Brazil has 26 States and each with autonomy to impose the ICMS tax rate over aviation fuel. There is also incidence of 5% of PIS/COFINS taxes over aviation fuel. In accordance with recent publication from the Brazilian Association of Airline Companies (Abear) the Brazilian tax treatment over aviation fuel is one of the most expensive in the world in domestic flights around 40% more expensive than international standards. The ICMS tax is not due on aviation fuel used for international flights.

Colombia

Under Colombian legislation, type 100/130 gasoline intended for aviation is exempt from the General Tax on Gasoline and ACPM, under Decree 568 of 2013.

Czech Republic

In general, aviation fuel is subject to excise duties in the Czech Republic. However, aviation fuel (under Combined Nomenclature No. 2710 12 31 or 2710 12 70) and jet fuel (under Combined Nomenclature No. 2710 19 21) used as fuel for aviation, testing, repair or maintenance of aircraft, except for mineral oils used for private pleasure flying, are exempt from excise duties.

Germany

Article 14 (1) (b) of Council Directive 2003/96/EC directs the EU member states to exempt energy products for use as fuel for flights other than private pleasure-flying from taxation under conditions which ensure the correct and straightforward application of such exemptions and prevent any evasion, avoidance or abuse. Member states may limit the scope of this exemption to supplies of jet fuel (CN code 2710 19 21).

For the purposes of the above stated Directive ‘private pleasure-flying’ shall mean the use of an aircraft by its owner or the natural or legal person who enjoys its use either through hire or through any other means, for other than commercial purposes and in particular other than for the carriage of passengers or goods or for the supply of services for consideration or for the purposes of public authorities.

Germany has put that Directive into law through Section 27 (2) of the Energy Tax Act (in German: “Energiesteuergesetz”) which states that aviation fuel (CN code 2710 12 31) which has a research octane number of 100 or more and jet engine fuel (CN code 2710 19 21) may be used in aircraft for flights without payment of taxes unless it is for private non-commercial aviation. Commercial activity in the sense of Section 27 (2) of the Energy Tax Act is deemed to exist if the activity is carried out with an aircraft for remuneration with the intention of making a profit and the entrepreneur acts at its own risk and responsibility (§ 60 (5) of the Regulation on Energy Tax). It is not necessary that the entrepreneur who performs the respective flights has a (commercial) operating license and an air operator certificate.

Greece

No. Pursuant to art. 78 par. 1 (a) of Law 2960/2001, energy products intended to be used for air transport are exempt from fuel tax (with the exception of private recreational flights, which are not exempt from fuel tax).

Israel

No, an excise tax exemption applies for fuel that is used for operation of the aircraft.

Likewise, according to Article 9 of the Open Skies Agreement, it may be assumed that the purchase of fuel for international air transport purposes would be exempt from Israeli VAT and ancillary duties. However, in practice, it seems that the VAT Division within the ITA is not tasked with or accustomed to interpreting or implementing the provisions of such agreement.

Italy

Aircraft operators can generally benefit of a VAT exemption on the purchase of fuel at Italian airports, to the extent that they operate aircraft for reward chiefly on international routes (pursuant to the national implementing rules of the EU Directive 2006/112 on the common system of value added tax).

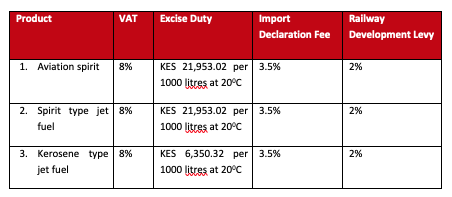

Kenya

Aviation fuel and other aviation fuel products are subject to the following taxes:

Mexico

Yes, jet fuel is taxed according to the special tax on production and services. The taxation rate is generally updated every year.

Nigeria

Petroleum products are not on the list of items expressly exempted from VAT in Nigeria. However, it has been industry practice not to charge VAT on petroleum product based on the reliance on a directive of the Petroleum Product Pricing Regulatory Agency not to charge VAT given the regulation of retail pricing and provision of subsidy to reduce the cost burden to citizens in relation to these “essential” products.

Norway

In addition to the CO2 tax mentioned in Section 13 above, there is a charge on importation and domestic production of gasoline. The current gasoline charge is between NOK 5,25 and 5,29 per litre. However, exemptions or subsidies are paid for gasoline tax used in aircrafts. Furthermore, the supply of specific goods, e.g. gasoline, for use by aircraft in international commercial aviation activities shall be VAT-exempt (zero-rated).

Panama

There are no aviation fuel taxes under the laws of the Republic of Panama.

Peru

According to Peruvian legislation the sale in the country at the level of producer or import of fuel “Turbo Jet A1” intended for aviation companies is not taxed with the ISC and VAT. However, airlines need to apply a Customs procedure, in order to not be taxed.

Portugal

An exemption is applicable to commercial aviation.

Puerto Rico

Yes. Section 3020.06 (a) of the Code, states that an excise tax shall be imposed, collected, and paid on each gallon or fraction thereof of the following fuels:

(1) Gasoline – 16 cents;

(2) Aviation fuel – 3 cents;

(3) Gas oil or diesel oil – 4 cents;

(4) Any other fuel – 8 cents.

However, gasoline, aviation fuel, gas oil or diesel oil or any other fuel subject to the provisions of the above-mentioned excise tax shall be exempt from the sale and use tax established in the Code.

Romania

In accordance with Romanian Fiscal Code, energy products delivered for use as a fuel for aviation, other than private aviation tourism is exempt from the payment of excise duties.

South Africa

- No

Spain

Fuel tax would exclusively apply to corporate and private aviation.

Switzerland

Switzerland levies mineral oil taxes on aviation fuels. However, airlines and other commercial aircraft operators are exempt from such mineral oil taxes if certain conditions are met.

United States (Miami)

The taxes generally assessed are described above. However, additional taxes may apply depending on a variety of factors, including, without limitation, the location of the aircraft, aircraft ownership structure, type of operations, and taxpayer status. All relevant tax aspects should be considered when structuring transactions. The information above should not be relied upon by the reader for legal advice as it is intended merely to serve as preliminary guide to the vast body of laws and regulations governing the taxation of aviation and aircraft in the United States on a Federal basis and in the State of Florida, merely as an example of a state tax regime, which differs from state to state among the fifty states in the nation. Aircraft owners must consider sales and use taxes, fuel taxes, property taxes, and a host of additional state-specific issues when planning for the acquisition and operation of general aviation aircraft. The information above intends to provide summary-level information about a wide range of tax issues affecting general aviation at the Federal and state levels. Since these materials are general in nature, readers are encouraged to obtain legal and tax advice from their own professional legal and tax counsel licensed in the state in which the activity is occurring based on specific facts and circumstances regarding their acquisition and/or use of aviation and aircraft.